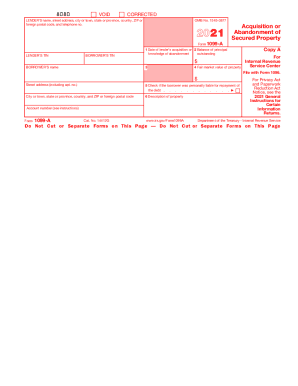

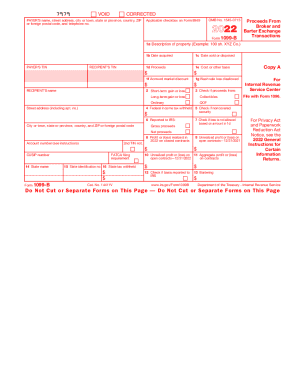

IRS 1099-A 2022-2025 free printable template

Show details

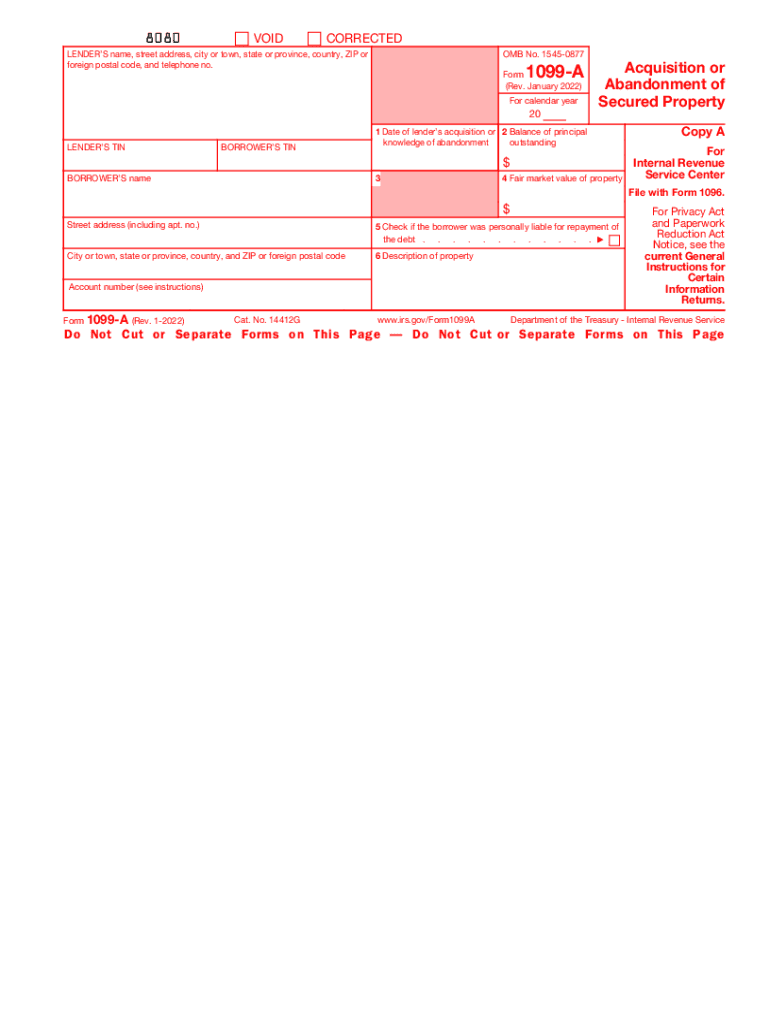

Attention: Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scalable,

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS 1099-A

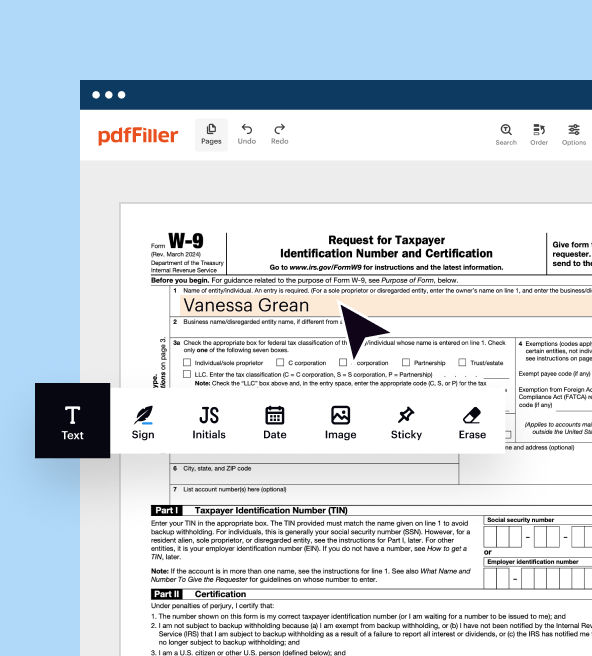

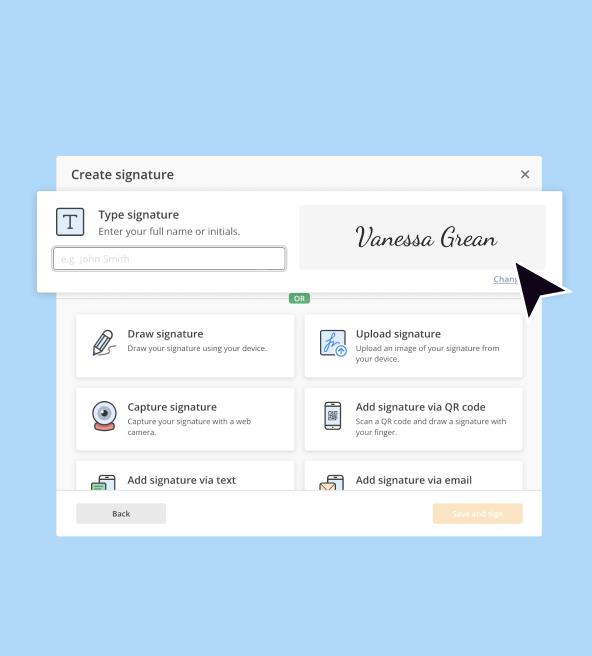

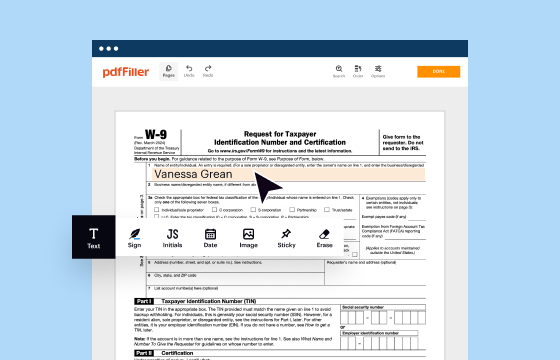

Step-by-Step Instructions for Modifying IRS 1099-A

How to Complete IRS 1099-A Accurately

Understanding and Utilizing IRS 1099-A

The IRS 1099-A form plays a critical role for taxpayers and financial institutions involved in real estate transactions, particularly when a property is foreclosed or transferred through other means. Understanding how to navigate this form can simplify your tax reporting obligations and ensure compliance with IRS regulations.

Step-by-Step Instructions for Modifying IRS 1099-A

Modifying the IRS 1099-A is crucial for accuracy. Follow these actionable steps to edit the form appropriately:

01

Gather all necessary financial documents related to the property.

02

Identify the correct version of IRS 1099-A based on the transaction date.

03

Carefully update the borrower’s name, Social Security Number, and address as needed.

04

Ensure the property’s address and account number are accurately reflected.

05

Review all financial details, including the outstanding principal balance, to guarantee precision.

06

Save the edited form in a secure location for future reference and filing.

How to Complete IRS 1099-A Accurately

Completing IRS 1099-A requires careful attention to detail. Here’s how to fill it out correctly:

01

Enter the lender’s information in Section 1.

02

Fill in the borrower’s details in Section 2.

03

Disclose the date of the acquisition of the property.

04

Input the fair market value at the time of acquisition.

05

Document the outstanding loan amount as of the acquisition date.

06

Verify all information for discrepancies before submission.

Show more

Show less

Recent Developments and Modifications to IRS 1099-A

Recent Developments and Modifications to IRS 1099-A

It's vital to stay updated on changes regarding IRS 1099-A. Recently, the IRS has adjusted the reporting thresholds and enhanced the e-filing requirements, which may affect how you complete and submit the form.

Essential Information Regarding IRS 1099-A's Function and Application

Defining IRS 1099-A

The Objective of IRS 1099-A

Who Is Required to Fill Out This Form?

Conditions for Exemptions from IRS 1099-A Filing

Key Components of IRS 1099-A

Deadline for IRS 1099-A Submission

Contrasting IRS 1099-A with Other Tax Forms

Covered Transactions in IRS 1099-A

Number of Copies Needed for Submission

Potential Penalties for Non-compliance with IRS 1099-A Filing

Required Information for Filing IRS 1099-A

Additional Forms That May Accompany IRS 1099-A

Where to Submit IRS 1099-A

Essential Information Regarding IRS 1099-A's Function and Application

Defining IRS 1099-A

The IRS 1099-A form, officially known as the Acquisition or Abandonment of Secured Property, is used to report the acquisition of property through foreclosure or other means. Lenders are typically responsible for issuing this form when a borrower has had a loan secured by real estate terminated.

The Objective of IRS 1099-A

Its primary purpose is to provide the IRS with information about transfers of property, which helps in determining any tax consequences for the parties involved. This disclosure assists the IRS in tracking property tax events, contributing to accurate tax assessments.

Who Is Required to Fill Out This Form?

The lender or financial institution is obligated to complete IRS 1099-A whenever it acquires secured property as a result of foreclosure, or when a borrower abandons the property. Borrowers must also be aware of their responsibility to report any relevant information associated with the form in their tax filings.

Conditions for Exemptions from IRS 1099-A Filing

Exemptions from filing IRS 1099-A may apply in specific situations, including:

01

Transactions involving a property with an outstanding balance of less than $600.

02

Foreclosure of properties where the debt is discharged in bankruptcy.

03

Transfers of secured property where the lender does not expect to recover any financial benefit.

Key Components of IRS 1099-A

IRS 1099-A includes several essential components that must be filled out correctly:

01

Part I: Lender's information - Name, address, and taxpayer identification number.

02

Part II: Borrower's details - Name, address, and Social Security number.

03

Part III: Financial information - Fair market value and outstanding balance of the loan.

Deadline for IRS 1099-A Submission

The IRS 1099-A form must be submitted by January 31 of the year following the transaction. This ensures timely reporting for both the lender and borrower, aligning with the overall tax filing deadlines.

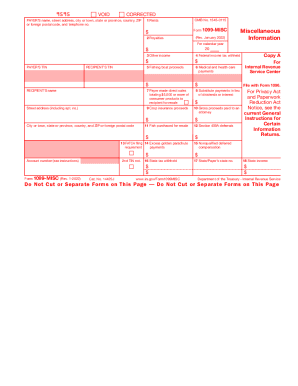

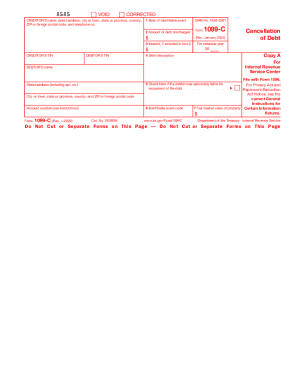

Contrasting IRS 1099-A with Other Tax Forms

IRS 1099-A differs from related forms such as IRS 1099-C (Cancellation of Debt) and IRS 1098 (Mortgage Interest Statement) through its specific focus on property acquisition or abandonment. Understanding these distinctions helps taxpayers identify which form applies to their situation.

Covered Transactions in IRS 1099-A

IRS 1099-A covers transactions related specifically to:

01

Foreclosure sales.

02

Property transfers where the lender acquires the secured property.

Number of Copies Needed for Submission

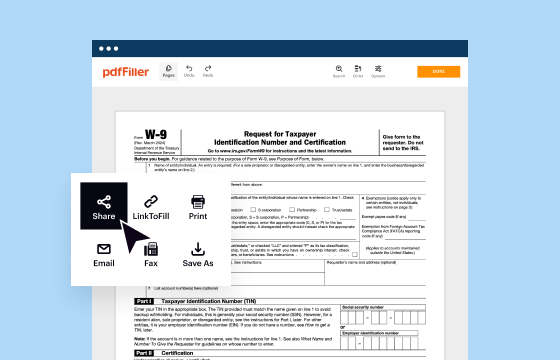

Typically, you need to file one copy of IRS 1099-A with the IRS and provide a copy to the borrower. Additional copies may be required based on specific state regulations or if copies are distributed to other involved parties.

Potential Penalties for Non-compliance with IRS 1099-A Filing

Failure to submit IRS 1099-A can result in significant penalties, which may vary depending on the severity of the violation:

01

Late Filing: A penalty of $50 per form may apply if filed within 30 days of the due date.

02

Inaccurate Information: Errors resulting in incorrect information can incur penalties up to $100 per form.

03

Failure to File: Not filing at all may lead to severe penalties of up to $270 per form.

Required Information for Filing IRS 1099-A

When filing IRS 1099-A, ensure you have the following information ready:

01

Lender’s name, address, and EIN or SSN

02

Borrower’s name, address, and SSN

03

Property description, including address

04

Outstanding balance and fair market value of the property at the time of acquisition

Additional Forms That May Accompany IRS 1099-A

In some circumstances, filing IRS 1099-A may necessitate accompanying forms, such as IRS 1099-C for cancellation of the debt or any pertinent state-specific forms required for property transactions.

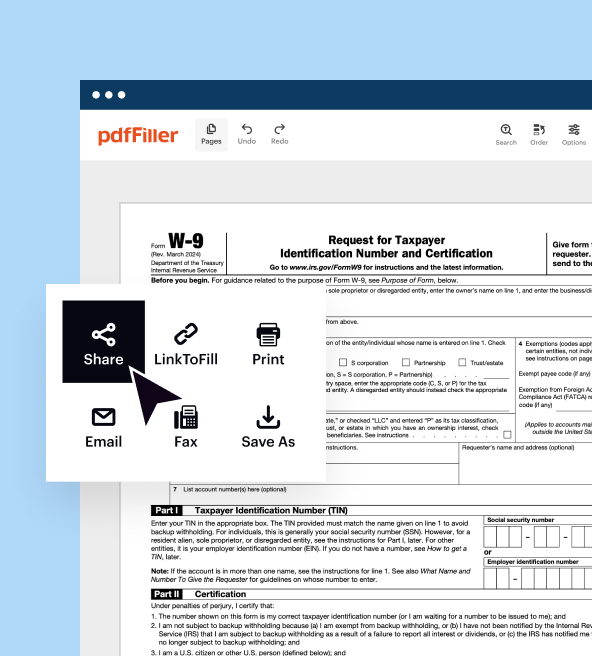

Where to Submit IRS 1099-A

IRS 1099-A can be submitted electronically through the IRS filing system or mailed to the designated IRS address based on your location. Be sure to check the IRS website for the most current submission guidelines and addresses.

Being well-informed about the intricacies of IRS 1099-A is essential for any taxpayer or lender involved in property transactions. For further questions or assistance, consider consulting a tax professional or utilizing tax preparation tools to ensure compliance and accuracy in your filings.

Show more

Show less

Try Risk Free

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.